Can I Eat My Cake and Still Have It

“What platform do you cool kids buy stocks on? And ideally one that allows you take loan against your portfolio. Also one with minimum fees too. Thanks.”

This was the question I asked last night before I went to bed. It was a question that was prompted because I wanted to experiment with investing in stocks, thanks to watching the WhatsApp status of Bafemsolar. Then it got me thinking, what if there was a platform for stocks where I could also have my stocks as collateral, to which I can take a loan against as a Nigerian living in Nigeria.

The responses I got were mostly Bamboo; most people buy their stocks on Bamboo, and only they offer the loan feature, thanks to their integration with Carrot Credit, the financer. When I heard someone mention the Carrot Credit, I remembered that they were recently in the news for raising $4.2m in seed funding to scale crypto and stock-backed lending in Africa. Also, checking a conversion from 2022 on WhatsApp from a friend, I was reminded that he could take loans on Bamboo through Carrot Credit then.

The Cost of Poverty

On the issue of loans, something I have realized as a Nigerian living in Nigeria is how hard it is for me to get access to credit facilities. The Monetary Policy Rate (MPR) from the Central Bank of Nigeria is at 27.5%, thanks to the crazy inflation in my country, so banks have to lend to you and also make a profit. But then the banks don’t serve a large percentage of their customer profile, which I do not fault them for. I know how the society here handles loan repayment, and it’s a role I won’t even pick up, even if I had a fat salary check.

So where do most of the population get access to credit from? Asides from family and friends, which in a poor country like mine is a limited source, loan apps, or should I say loan sharks behind flashy UIs? The rates these loan apps use are something I wouldn’t touch ever. I wouldn’t even advise my enemy to take a loan from them. But unfortunately they are the most accessible loan option to a large number of the population.

My beef with traditional banks

I dislike banks a lot. When I was younger and I had to go to the bank, I spent a long time in waiting queues, and it was something I didn’t like. Around 2018, I got a GT bank account as a student, and I was heavily using it. I didn’t use an app with it, and I just relied on USSD for transfers and my ATM card for cash withdrawals. I can remember the largest transaction I did then was a ₦220,000 transfer, which was payment for the 3-bedroom flat I shared with my friends while in school. To even enact that transaction, I had to raise my USSD limit and even split the transaction into batches.

Fast forward to late 2019, I heard about Kuda bank and I signed up as one of the early batch of users. It became my primary bank, while I only used my GT bank for card-related transactions. I collected ATM cards from Kuda bank twice, but I never activated them. For me, a security habit I have is having an account for only card transactions where I don’t save/keep money in and having one with no card attached to it, that I use primarily. I even got eligible for ₦30,000 overdraft from them, which is a feature I use till today and has helped me a lot.

However, after a while, I can’t remember the year, but I think I made the jump to Palmpay in 2022. This was largely due to how fast transfers were completed using them. I would send money and be sure there was no issue with my bank, and that it was the receiver’s bank (usually traditional commercial banks) with issues. Also, they offered FREE transfers (marketing freebie, I agree). I could send a large sum of money and not pay for it. I didn’t have to bother about SMS, Account maintenance charges, etc.

My costly mistake

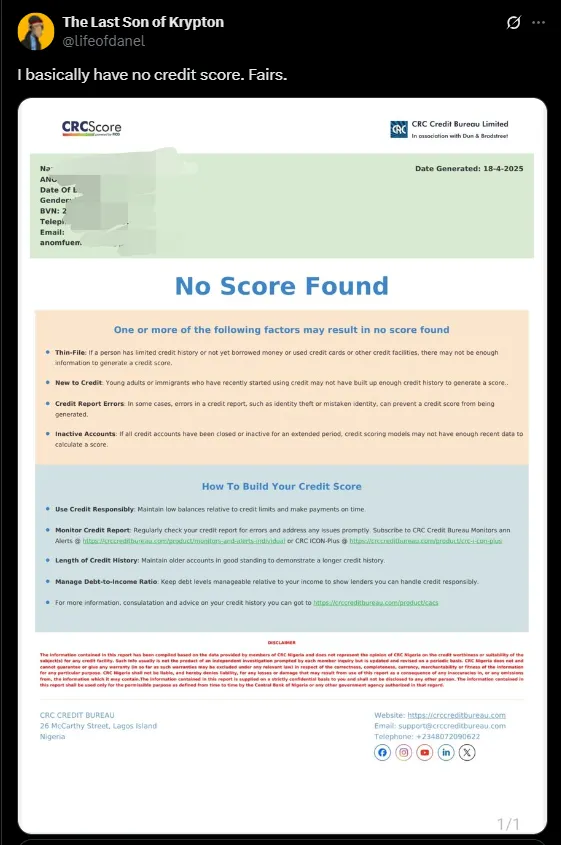

So for over 5 years, I have been relying heavily on fintechs to facilitate my transactions. 99% of my transaction volume happens outside of the traditional commercial bank. The mistake of enabling that behaviour is that, while someone like me would be creditworthy, I have priced myself out of that market by my actions. Since 2018 of having a GT bank account, today is the first time I am logging into the bank app on my phone. I have never used it, and after a conversation with someone on Twitter and him sharing this article, I realized I should be doing more.

I tried to use their Quick Credit product and saw that I was ineligible for it, which was expected as my volume from the 1st of January to today was roughly ₦500,0000. Which is a volume I could do x10 of in a month on Palmpay. If I were doing that volume on GT bank, I would have been eligible for credit from them. As much as I have a beef with them, I need them if I am going to have access to one of the best credit rates available in the country. They also have the necessary connections to other better credit rates. Palmpay offers a credit facility, but I am not interested, thanks to their rate.

What will I do?

For an understanding of who I am, I am pretty much a crypto native person. I like the ease I get with using stablecoins. I rarely keep money in naira; I just hold it in dollar stablecoins. I only off ramp to my Palmpay account when I want to pay for a particular item in naira. I also want to diversify my small money between some naira and dollar-based funds. I used to do yield farming on Morpho Protocol, but after looking at the possible risk, I stopped. To me, it’s better I use traditional channels that are insured and protected by relevant government bodies. If I lose my small money to a hack, I might not survive it. So I will be experimenting with platforms like Piggyvest (recently did a safelock on it and it was nice to spend the interest), Fairmoney (they have the better rates from what I have seen), Bamboo, etc.

I do not have a recurring salary that enters any of my naira accounts, so going forward, I will be paying myself a regular salary into my GT account from a business account. Aside from it being good for boosting the algorithm to work for me, credit-wise, it is also a very good thing for visa-related applications. Embassies want to see that you have a consistent inflow of money from a safe source, which a salary account does.

Conclusion

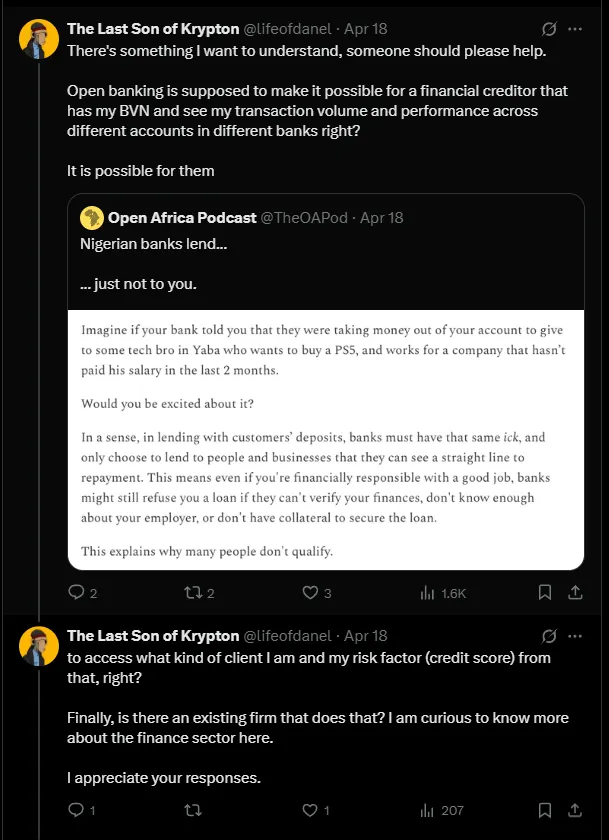

I do hope all relevant parties involved get to participate in open banking more, so someone like me won’t be punished just because I use another platform for my financial transactions. Recent news shows that the CBN has approved the launch of open banking, so I am hopeful things get better. Mono has already built the rails for open banking here, and I hope they embrace them more.

I strongly believe that with the right financial knowledge and interest rate, loans aren’t bad, and it is something I look forward to building a credit score with. I am just a young man trying to earn an honest living on the internet. Thanks for reading.

This article was originally published here.